Brazil's Banks Adjust View of Their Market

Por um escritor misterioso

Last updated 03 maio 2024

Dick Meyer speculates that big countries like Brazil which are making large investments in IT may quickly expand microfinance through commercial banks and eventually outpace other countries that have invested in NGOs and other specialized microfinance institutions. He quotes a New York Times article which explains how for decades, banks in Brazil almost exclusively catered to the middle and upper classes, aiming at a small but wealthy minority in a country with one of the world's most skewed income gaps. That is now starting to change, in part because Brazil's moneyed classes are already over-served by banks. That, analysts say, means the growth potential for financial institutions at the high end of the market is diminishing and they are waking up to the fact that the low-income classes are going to be the biggest source of growth for the future. Under new rules, banks can set up kiosks and banking terminals in supermarkets and drugstores instead of opening and running new branches. Because Brazil's banks are highly automated, these terminals tend to be inexpensive to operate, making it easier for banks to get a return on their investment. To encourage lending to the poor, the government also allows banks to use up to 2 percent of reserve requirements - money that would otherwise be parked at the central bank - to offer low-interest loans to low-income customers. Banks like the privately owned Lemon Bank in São Paulo that operates exclusively through automated teller machines in outlets like bakeries and corner stores, are more interested in providing basic financial services than in offering credit. "There's a lot of romanticizing about credit," said Michael Esrubilsky, Lemon Bank's general manger. "What our client really needs is convenience to pay bills, to not have to spend an hour to get to the nearest bank and to not have to spend 10 reais on transportation to get back and forth."

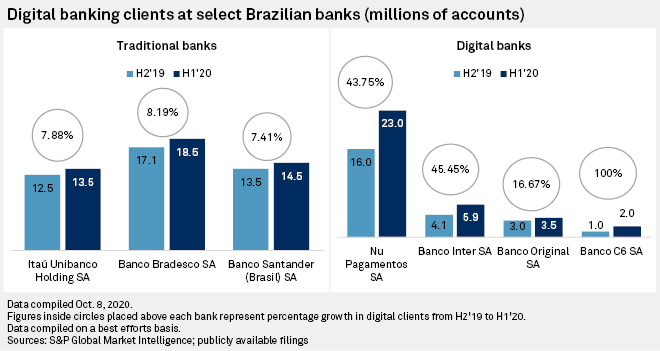

Key Data on the Current State of Neobanks in Brazil

Banco do Brasil - Wikipedia

Fintechs, big banks on a quest for digital clients in Brazil

Concentration increasing in Brazil's banking market - BNamericas

Public Policy Notes - Towards a fair adjustment and inclusive growth

Brazil's Surprising Fintech Tailwind

Brazil's banking system braces for new ESG regulation - LatinFinance

Brazil Inflation Rate

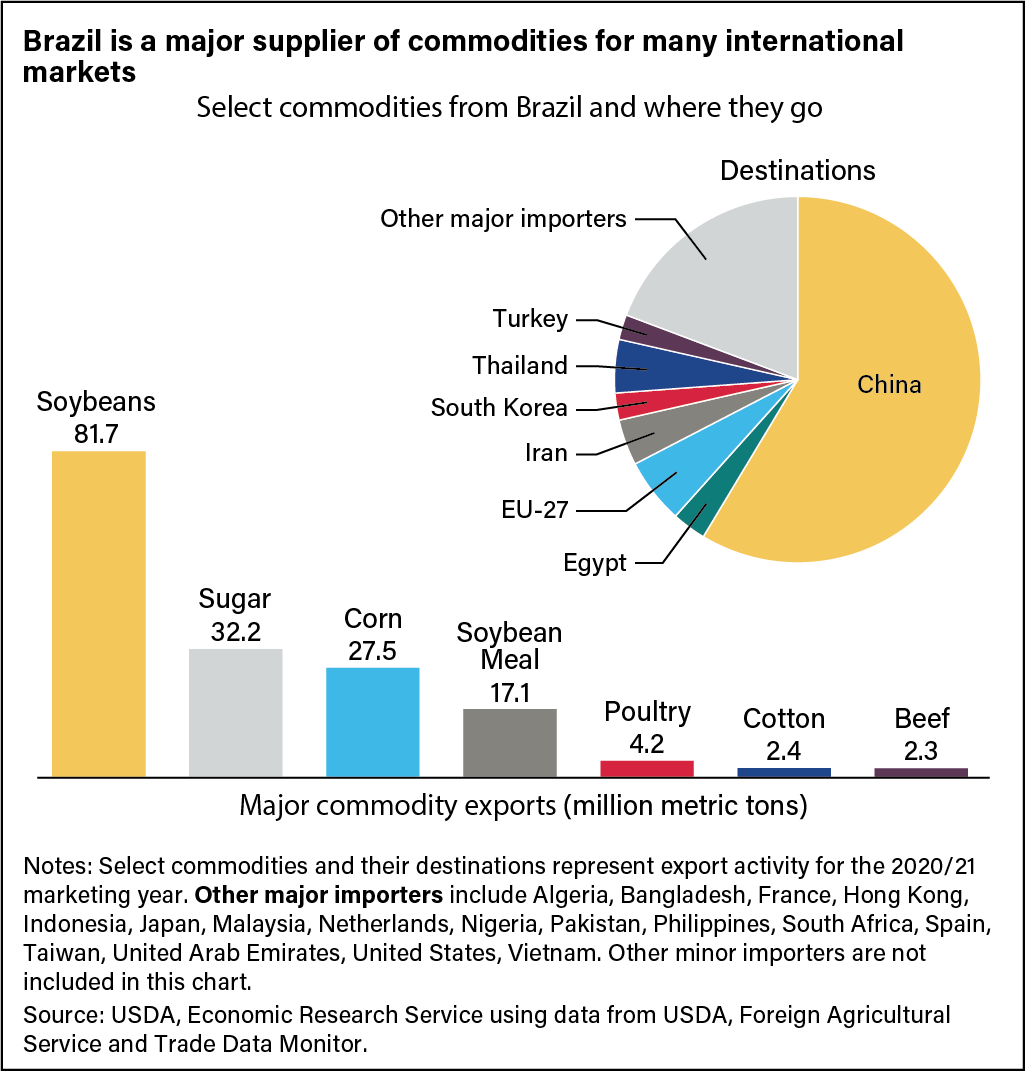

USDA ERS - Brazil's Momentum as a Global Agricultural Supplier

Brazil Central Bank Reinforces Cautious View on Fight to Bring

Visualizing the Top 10 Biggest Companies in Brazil

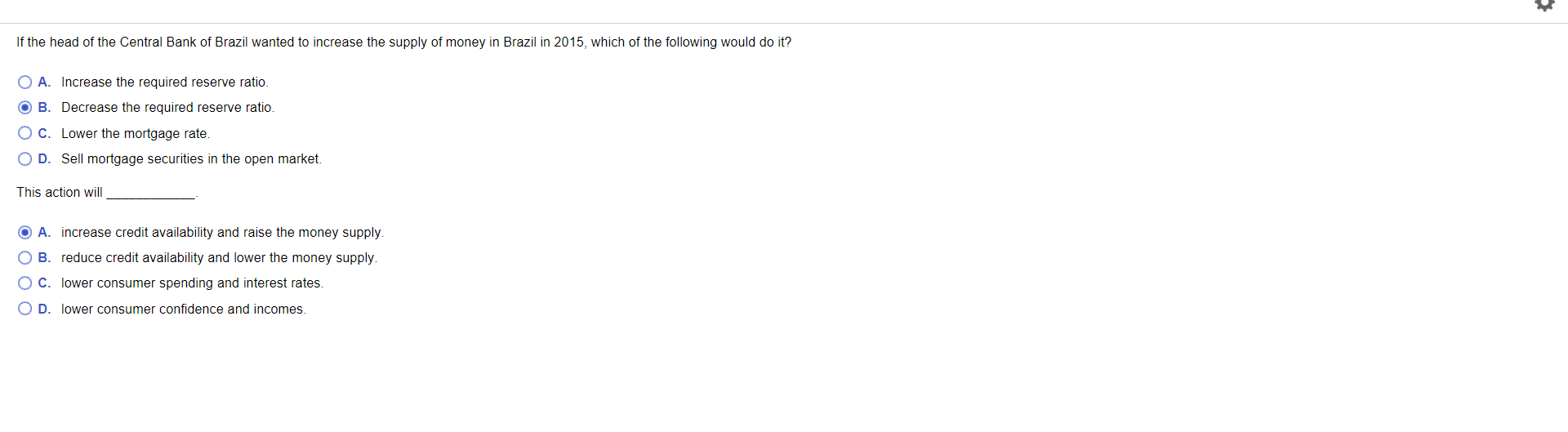

Solved If the head of the Central Bank of Brazil wanted to

Party of Brazil's da Silva Grumbles Over Policies - WSJ

Recomendado para você

-

Free Course: Pluralidades em Português Brasileiro from Universidade Estadual de Campinas03 maio 2024

Free Course: Pluralidades em Português Brasileiro from Universidade Estadual de Campinas03 maio 2024 -

Free Course: Explorando os recursos educacionais da Khan Academy from Fundação Lemann03 maio 2024

Free Course: Explorando os recursos educacionais da Khan Academy from Fundação Lemann03 maio 2024 -

Harvard CS50 in 2023: How to Get a Free Certificate — Class Central03 maio 2024

Harvard CS50 in 2023: How to Get a Free Certificate — Class Central03 maio 2024 -

Massive List of MOOC Platforms Around the World in 2023 — Class Central03 maio 2024

Massive List of MOOC Platforms Around the World in 2023 — Class Central03 maio 2024 -

![Conference Talks Talk: Machine Learning Pipelines con K3s y Argo from CNCF [Cloud Native Computing Foundation]](https://ccweb.imgix.net/https%3A%2F%2Fimg.youtube.com%2Fvi%2F-yiY98sc73I%2Fhqdefault.jpg?ar=16%3A9&auto=format&cs=strip&fit=crop&h=380&ixlib=php-4.1.0&w=535&s=8109b2f3ede98f08586ea24fc8f98a6c) Conference Talks Talk: Machine Learning Pipelines con K3s y Argo from CNCF [Cloud Native Computing Foundation]03 maio 2024

Conference Talks Talk: Machine Learning Pipelines con K3s y Argo from CNCF [Cloud Native Computing Foundation]03 maio 2024 -

banco-central-do-brasil03 maio 2024

banco-central-do-brasil03 maio 2024 -

Streann Media Powers the Panamerican Games Connecting 25 Million Hearts and Screens03 maio 2024

Streann Media Powers the Panamerican Games Connecting 25 Million Hearts and Screens03 maio 2024 -

LOFT CENTRAL de ITAIPAVA - GRANJA BRASIL, Itaipava – Updated 2023 Prices03 maio 2024

LOFT CENTRAL de ITAIPAVA - GRANJA BRASIL, Itaipava – Updated 2023 Prices03 maio 2024 -

Summer in Brazil The Stone Center03 maio 2024

Summer in Brazil The Stone Center03 maio 2024 -

v.13 (1970) - Check-list of birds of the world - Biodiversity Heritage Library03 maio 2024

você pode gostar

-

Ellie The Last of Us 2 Wig- Bettercos - Cherio Store03 maio 2024

Ellie The Last of Us 2 Wig- Bettercos - Cherio Store03 maio 2024 -

Camiseta Oakley - Skull03 maio 2024

Camiseta Oakley - Skull03 maio 2024 -

PowerWash Simulator PC Steam Digital Global (No Key) (Read Desc03 maio 2024

PowerWash Simulator PC Steam Digital Global (No Key) (Read Desc03 maio 2024 -

O Tabuleiro da Baiana restaurants, addresses, phone numbers, photos, real user reviews, Av. Cerro Azul, 139803 maio 2024

O Tabuleiro da Baiana restaurants, addresses, phone numbers, photos, real user reviews, Av. Cerro Azul, 139803 maio 2024 -

minecraft java edition03 maio 2024

minecraft java edition03 maio 2024 -

Crie um Logotipo Grátis Online com Imagens no Canva e Destaque-se! - Atividade Cerebral by Mariana03 maio 2024

Crie um Logotipo Grátis Online com Imagens no Canva e Destaque-se! - Atividade Cerebral by Mariana03 maio 2024 -

Reddit - Dive into anything03 maio 2024

Reddit - Dive into anything03 maio 2024 -

Seleção vence Cuba, garante o primeiro lugar no grupo e o 100% nos Jogos Pan-Americanos – CBBS03 maio 2024

Seleção vence Cuba, garante o primeiro lugar no grupo e o 100% nos Jogos Pan-Americanos – CBBS03 maio 2024 -

Yamaha 5UH-F1500-00-00 Front Fender Assembly; New # 5UH-F1500-G1-0003 maio 2024

Yamaha 5UH-F1500-00-00 Front Fender Assembly; New # 5UH-F1500-G1-0003 maio 2024 -

Pedro Espinoza - 2021 - Cross Country - New Mexico State03 maio 2024

Pedro Espinoza - 2021 - Cross Country - New Mexico State03 maio 2024